Could the banker be our friend: Using lending practices to further energy efficiency

I’ve been trying to think of ways to increase awareness and demand for energy efficiency in NEW construction, without radically changing our economic system. In other words, how to make for-profit building in a capitalist system a bit more energy friendly. (Disclaimer: capitalism requires nonstop growth, which is impossible, so this idea has a fatal flaw from the get go and I know that. But something is more than nothing.)

So here is the idea:

When you apply for a loan, and the taxes and insurance will be escrowed, the escrow amount factors into the size of the payment the lender thinks you can repay. Suppose we treated utility billing the same as escrowed taxes and insurance? Today, we sort of wave our arms around and say “building in energy efficiency saves you money later” but in the rush to apply for a loan that desirable notion doesn’t leap off the pages you get from the lender. By tying utility billing to the escrow amount, it all gets laid right out with dollar signs. It seems like that way people would be encouraged to really think about the issue together with points, term, and interest rate. “Great, I qualify for Loan X…. how much house can I build with Loan X ?” Longterm utility billing should be on the table at the lender’s office, shouldn’t it?

I’ll be the first to agree that merely doing energy efficiency does not a green society make.

Thoughts about the idea itself anyone?

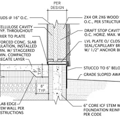

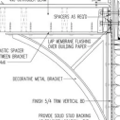

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

Steve,

Your idea exists; such mortgages are generally called "energy-efficient mortgages." If you Google the term, you'll find lots of information on the idea.

I would love to see the Property Assessed Clean Energy funding mechanism working for energy-efficient upgrades to existing homes and businesses. Learn more about the program athttp://www.veic.org/resourcelibrary/PACE.aspxand explain why Fannie and Freddie are trying to kill it...

Thanks Martin, and well whaddya know? There's already a push to introduce such legislation in the senate, not that it would go anywhere fast.

"Senate bill would make energy-efficient mortgages mainstream"

http://www.grist.org/article/2010-08-18-bennet-bill-would-make-energy-efficient-mortgages-mainstream

Steve

I've been doing a lot of research on EEMs for a client that will hopefully make its way into a post here soon. One thing I discovered is that the rules changed recently to allow larger loan amounts and really great deal on mortgage insurance but the loans are so rarely used that the old forms that our local bank had never ran out and so the new forms never made it into the branch office laying out the rules for the new homes.

另一个问题,就是你真的震惊了我need to energy model the house at code minimum and then again with the highest pay-back items modeled and then the lower pay-back items in order to show different energy savings options and associated itemized costs. since we never build a code minimum house we never bothered to model it that way and have no idea what the first- cost savings would be to build that way or the energy savings that are embedded into our standard package. All the options we offer are the ones with very long term return on investment. the items that have fast return are all standard for us (and should be code minimum in my view).

We're gathering a bunch of Green Builders, architects, building inspectors and environmental groups with the Governor and other allies on Tuesday morning to argue for adoption of the 2012 IRC code as soon as possible here in North Carolina.

On the weatherization front I have an alternative to PACE and HomeStar that may interest you:

http://www.chandlerdesignbuild.com/files/Market_Driven_Weatherization_012510.pdf