Geothermal Tax Break

Has anyone used the federal tax break for geothermal? If the system costs $30K + 10k for a well = $40K total when I file my taxes does Uncle Sam cut me a check for $40k x 26% = $10,400? Or do I just get to claim a higher itemized deduction of an additional $40K, therefore only lowering my taxable income by $40K? One gets me back $10,400 the other only gets me back $3-5k.

I just don’t want to be surprised if I invest this money and only get back 1/2 what I’m expecting.

thanks,

Steve

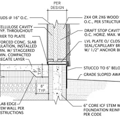

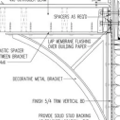

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

I am not your tax adviser but I think it is a credit you can subtract from what you owe Uncle Sam. It is not refundable so you can use the credit against what you owe in tax over the next few years. They will refund moneys you had withheld from you pay checks but more.

From the bids I have looked at the well/loop costs are more like 50-70% not the 25%in your post.

I have yet to see a BEopt model where ground source HP was a winner over air source HP with or without a tax credit.

Walt

It’s a tax credit, which is MUCH more valuable than a tax deduction.

Thanks

For those in Vermont, Efficiency Vermont is now offering rebates up to $2100 per ton of heating capacity on new geothermal. That's in addition to the Federal tax credit.