Solar ITC Question–any CPAs lurking here?

At first read to a layperson (me), it makes perfect sense that pretty much anyone can install a solar PV system and qualify for the ITC (Investment Tax Credit). There’s a residential version (we’re all fairly familiar with this one, yes?) and a business version (seehttp://solaroutreach.org/wp-content/uploads/2015/03/CommercialITC_Factsheet_Final.pdf

and

http://energy.gov/savings/business-energy-investment-tax-credit-itc) of said tax credit). So it seems clear to me that under the residential version, my owner-occupied duplex would only qualify for a tax credit on half of a solar install price, since it specifically excludes rental properties. Further, it seems clear that SOMEone out there wants business to be incented to install solar. My rental property, it’s technically a business, right? So, then, why do I continue to get conflicting information about whether I’d qualify under the business ITC to get the 30% tax credit on PV installs?

Asking my family’s accountant basically leads me here: “…I believe you and I have seen references to “commercial” or “business” property. I think that terminology does not include residential rental property for these purposes. Please forward anything you find which you think will contribute to a different conclusion.”

In a nutshell, does anybody here have any experience with claiming the 30% credit on residential rental properties, and perhaps have anything to cite?? I know this is better suited to an accountant-focused forum, but figure I’m more likely to find solar aficionados here at GBA…

Thanks!

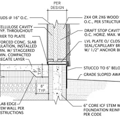

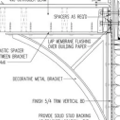

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

I don't know if this helps but from a mortgage lending perspective if you reside within a 1-4 unit property it is considered your primary residence and not a rental property.

I would also check your local tax code to see if you qualify for a homestead exemption if you don't already have it. If you do then I don't see there being an issue.

Thanks, Chris. Unfortunately, the mortgage perspective means nothing to the IRS. In fact, it's pretty cut-and-dry that only the percentage that's owner occupied (and then only the portion of time it's resided in, in the case of a second home, etc) is allowable for the credit, under the residential ITC...